How AI Can Assist Your Content Marketing for Financial Services

Financial services marketers operate in an environment defined by trust, regulation, and intense competition for attention. Consumers expect clear, educational content that helps them make confident decisions about their finances. But to reach your target audience, you must find ways to stand out in traditional search and generative AI search experiences which reward expertise, authority, and topical relevance.

Financial institutions face mounting pressure to produce more content across products, audiences, and lifecycle stages—often with limited internal resources and strict compliance requirements. This is where AI content marketing tools for financial services can deliver real value.

When used strategically, AI for topic and keyword generation can help finance marketers uncover high-impact content opportunities, streamline meticulous workflows, and scale content planning. With the necessary oversight and governance, quality can be improved, not diminished.

Below is a step-by-step guide to using AI to identify, validate, and prioritize content opportunities for financial institutions.

Interested in integrating AI to support your finance content strategy?

Primacy can help

1. Audit Existing Content with an AI Assist

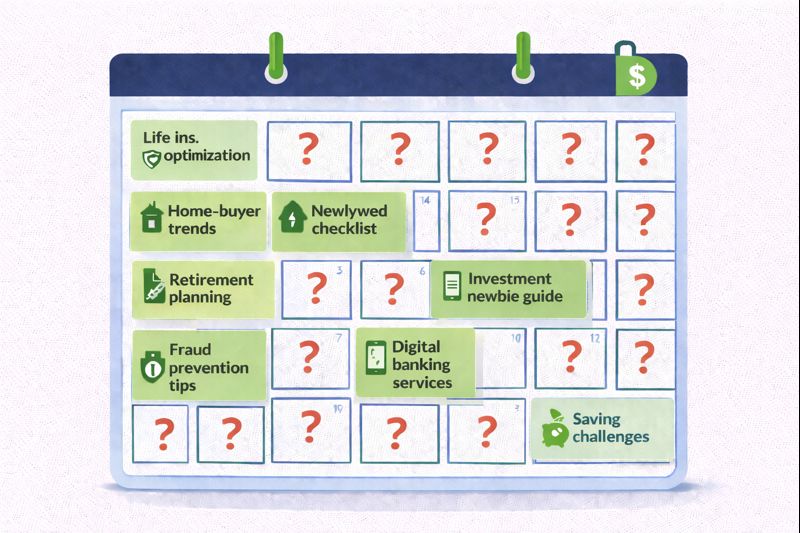

While finance marketers may have a demanding content calendar to keep up with, it’s important to first understand what your website and content ecosystem are missing. Investment companies, banks, and other financial institutions’ websites are often large, multifunctional, and built over time—resulting in uneven coverage across products, educational topics, and audience needs.

An AI-powered site auditing tool such as Ahrefs can analyze your website’s content at scale to uncover gaps by:

- Categorizing existing content by product, service, or audience

- Identifying weak, outdated, or underperforming pages

- Surfacing omitted educational topics consumers frequently search for

- Comparing your content coverage against competitors

- For example, a competing bank may rank well for educational content around “how high-yield savings accounts work,” while your site only includes a product overview page. AI-driven gap analysis can highlight these missed opportunities quickly and objectively.

This step provides insights which will help as you move through this process to determine where content investments will have the greatest impact—both for SEO/AIO performance and consumer trust. Primacy can help you to develop the right AI tools for your content strategy.

2. Use an Agent to Scale Ideation for Key Financial Audiences

Now that you’ve determined where you have thin or nonexistent content, the question becomes: What should you publish next? In the past, answering that question for the weeks and months to come meant hours spent in your SEO platform, pulling insights from multiple teams, and piecing everything together manually. Today, an AI content generator agent can do much of that heavy lifting—quickly translating data into relevant, audience-driven topics.

To make ideation effective, start by grounding your AI with essential inputs such as:

- Any results from your audit that should inform content ideation

- Customer personas (e.g., first-time homebuyers, retirees, small business owners)

- Needs around your customer journey stages

- Common pain points and customer questions

- Strategic goals (e.g., mortgage growth, digital adoption, wealth management awareness)

You should also clarify the formats you will ultimately be creating—blogs, FAQs, calculators, videos, or guides—so your agent aligns its output with real execution needs.

For example, if your institution wants to grow mortgage applications, an AI keyword generator might surface search topics such as:

- “how much house can I afford”

- “fixed vs adjustable-rate mortgage explained”

- “first-time homebuyer mistakes to avoid”

These insights help finance marketers generate a wealth of relevant, audience-first content ideas without starting the process from scratch each time you return to uncover new ideas.

3. Validate Search Opportunity—Faster with AI

By integrating an SEO API such as SemRush, your AI agent can go beyond ideation to validate which topics are worth pursuing. Customize your content marketing agent (or use a workflow) to be a true AI keyword generator, and it can analyze search behavior, emerging trends, and competitiveness—saving you hours of manual research.

AI-powered keyword insights can provide:

- Relevant long-tail and question-based keywords

- Search volume and keyword difficulty

- Traffic potential across related terms

- SERP features that may influence visibility

- GenAI search trends to assist in AIO

For example, a financial institution focused on personal finance education might discover keyword opportunities such as:

- “how to build credit fast”

- “credit score ranges explained”

- “does checking your credit lower your score”

Validating your keywords ensures your content strategy is driven by real consumer demand—not assumptions. It also helps prioritize topics that balance compliance-friendly education with achievable SEO performance. While this is the third step of the process, it’s actually built into your single prompt and will inform your agent’s ultimate recommendations.

4. Avoid Internal Competition

Before producing new content, you must ensure your ideas are truly net-new, so this last part of your agent’s instructions (prompt) is crucial. Financial institution websites often contain duplicative educational resources, product pages, and blog posts created over many years.

AI excels at cross-referencing your proposed ideas against existing content to ensure originality. You can configure an AI agent to take its initial recommendations and after validating their search potential:

- Scan your sitemap or content repository for related topics

- Identify existing coverage of proposed ideas

- Evaluate depth, clarity, and usefulness of existing content

- Recommend whether to expand/refresh those assets or create new ones

For example, if your agent suggests “how compound interest works,” the system may detect a basic explanation buried within a savings account page. Rather than publishing a redundant article, you may choose to expand that explanation into a dedicated, educational resource that can be reused across channels.

By building this requirement into your agent’s prompt, the ultimate output will contain content opportunities that are thoroughly validated for search value and avoid competing with existing content.

Governance Is Essential When Using AI for Financial Institutions

AI can be a powerful accelerator—but governance is essential in regulated industries like finance. As you integrate AI into your content workflows, clear guardrails must be in place.

Best practices include:

• Using secure (usually paid) AI tools when working with proprietary or sensitive data

• Documenting and implementing access controls and oversight for AI usage

• Providing brand, legal, and compliance guidelines to AI tools

• Requiring human review by compliance, legal, and editorial stakeholders before publication

Incorporating AI into your content creation should enhance financial education and transparency—not introduce risk.

Finance content marketers aim to deliver educational, trustworthy, and discoverable content at scale, and thoughtfully implemented AI accelerators can support their research, ideation, and planning.

By evaluating your existing site, generating audience-aligned ideas, validating opportunities with SEO data, and ensuring new content isn’t duplicative, financial institutions can build a more efficient, scalable, and effective content marketing strategy. AI empowers teams to focus on the strategy and storytelling—while automating the most time-intensive parts of content planning.